reit dividend tax south africa

Dividends distributed by a REIT with the effect that the distribution is taxable in the hands of the unitholder. Submit your tax return right here.

Doing Business In The United States Federal Tax Issues Pwc

Treasury formally published the REIT tax legislation for South Africa on 25 October.

. SA REITs offer investors a recurring cash distribution yield that can be reinvested thereby providing a powerful. This combined with the tax benefits detailed above makes the REIT sector an attractive. Interest is exempt where earned by a non-resident who is physically absent from South Africa.

As from 1 January 2014 foreign investors will be subject to the dividends withholding tax subject to any DTA reductions if applicable. Dividend holding tax has not been taken off. Recent introduction of REIT legislation to South Africa show some commitment from National Treasury in ensuring the tax dispensation for South African REITs is suitable for its intended purpose.

Refer section 101ki of. REIT Dividends received by South African tax residents must be included in their gross income and will not be exempt from income tax in terms of the exclusion to the general dividend exemption contained in paragraph aa of section 101ki of the Income Tax Act because they are. 2012 in the 2012 Taxation Laws Amendment Bill.

Fundrise just delivered its 21st consecutive positive quarter. Property owning subsidiaries of REITs also benefit from the section 25BB tax dispensation. For dividends categorized as ordinary income the rate at which you are taxed will vary based on your income and tax bracket.

The rate in column 2 applies to dividends paid by a RIC or a real estate investment trust REIT. These distributions are however exempt from dividend withholding tax in the hands of South African tax resident unitholders provided that the South African resident unitholders have provided the following forms. For example if your taxable income was 50000 in 2021 youd be taxed at a rate of 22 for ordinary income distributions paid that year.

Reit Dividends Tax. The REIT real estate investment trust is an international standard which permits investors to invest in property assets through a vehicle which largely provides for tax transparent treatment. Foreign shareholders of SA REITs are levied a dividend withholding post tax at the current rate of 20 but this can be reduced in terms.

This is a listed property investment vehicle. Dividends received by a South African taxpayer are generally exempt from income tax. From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on interest from a South African source payable to non-residents.

TaxTim will help you. South African REITs own several kindof commercial s such asproperty shopping centres office buildings factories warehouses hotels hospitals and residential. The trust or if relevant the beneficiary of the trust will however be exempt from dividends tax in respect of such dividend.

Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. This took the form of a new section section 25BB in the Income Tax Act. To qualify for the South African REIT dispensation a the REIT either a company or a trust must be tax resident in South Africa and be listed as an REIT in terms of the JSE.

A REIT and a controlled company must also consider dividends tax transfer duty securities transfer tax and VAT. Do Your Tax Return Easily. In order to be tax deductible any such dividend must meet the.

In South Africa a REIT receives special tax considerations and offers investors exposure to real estate through shares listed on the Johannesburg Stock Exchange JSE. Distributions from REITs must be included in the taxpayers taxable income and will be taxed per their marginal tax rate. REITs - the reduced corporate income tax rate Author.

The foreign tax will have to be shown to be a tax on income that is substantially similar to a tax in terms of a South African. Section 25BB is quoted in the. REIT Dividends - South African tax resident shareholders.

The REIT regime in South Africa aims to create a flow though vehicle for income tax purposes. While the sector faced immense challenges when the Covid-19 pandemic hit South. Any REIT dividend excluding a share buy-back from a company that is a REIT at the time of the distribution of that dividend but including interest paid on a debenture forming part of a linked unit held in a REIT.

Dividends received from REITs are not exempt from income tax and will be subject to income tax in the hands of the recipient taxpayer. In terms of Reit tax laws that came into effect in 2013 JSE-listed property funds must pay out 75 of their taxable income to investors in order to be a. 97601004668 30632-P Contact Us Personal Data Notice Terms Conditions Help We use cookies to give you the best experience on our Website.

For the 2012 tax year Foreign interest and foreign dividends are only exempt up to R3 700 out of the total exemption. A REIT stands for Real Estate Investment Trust. A fundamental part of the regime relates to the ability of the REIT and its subsidiaries to deduct for income tax purposes dividends declared and paid to their immediate shareholders.

Foreign natural persons and trusts Dividends received by or accrued to a foreign investor prior to 1 January 2014 from a REIT or a CPC will be exempt from dividends tax and South African income tax. A summary of the withholding tax rates as per the South African Double Taxation Agreements currently in force has been split into two parts Africa and the. A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income producing real estate assets.

Dividend tax withheld at 20 Distribution to investors21 Tax on investors taxable incomeLl Net return for the individual investors all REIT RI 00000 RIOOOOO RIOOOOO R45OOO R55OOO. REIT Dividends - South African tax resident shareholders. Coca-Cola Beverages Africa CCBA presents an exciting opportunity for an experienced Direct TaxSee this and similar jobs on LinkedIn.

Cape Town South Africa Site secured by Comodo Security. The rate of Dividends Tax increased from 15 to 20 for any dividend paid on or after 22 February 2017 irrespective of declaration date unless an exemption or reduced rate is applicable. You are also eligible to deduct up to 20 of qualified business income from.

Losses before tax for trucking services meanwhile narrowed down by -567yoy due to continuous cost-saving. Posted 2 August 2015 under Tax QA Peter says. Following the introduction of section 25BB into the South African Income Tax Act in 2012.

Asset class for long-term investors. 1 August 2015 at 1643 Hello I have received a Tax Certificate from my stock broker and it says Total nett REIT dividends for period R3709. More than 25 countries in the world use similar REIT models.

How Reit Regimes Are Doing In 2018 Ey Slovakia

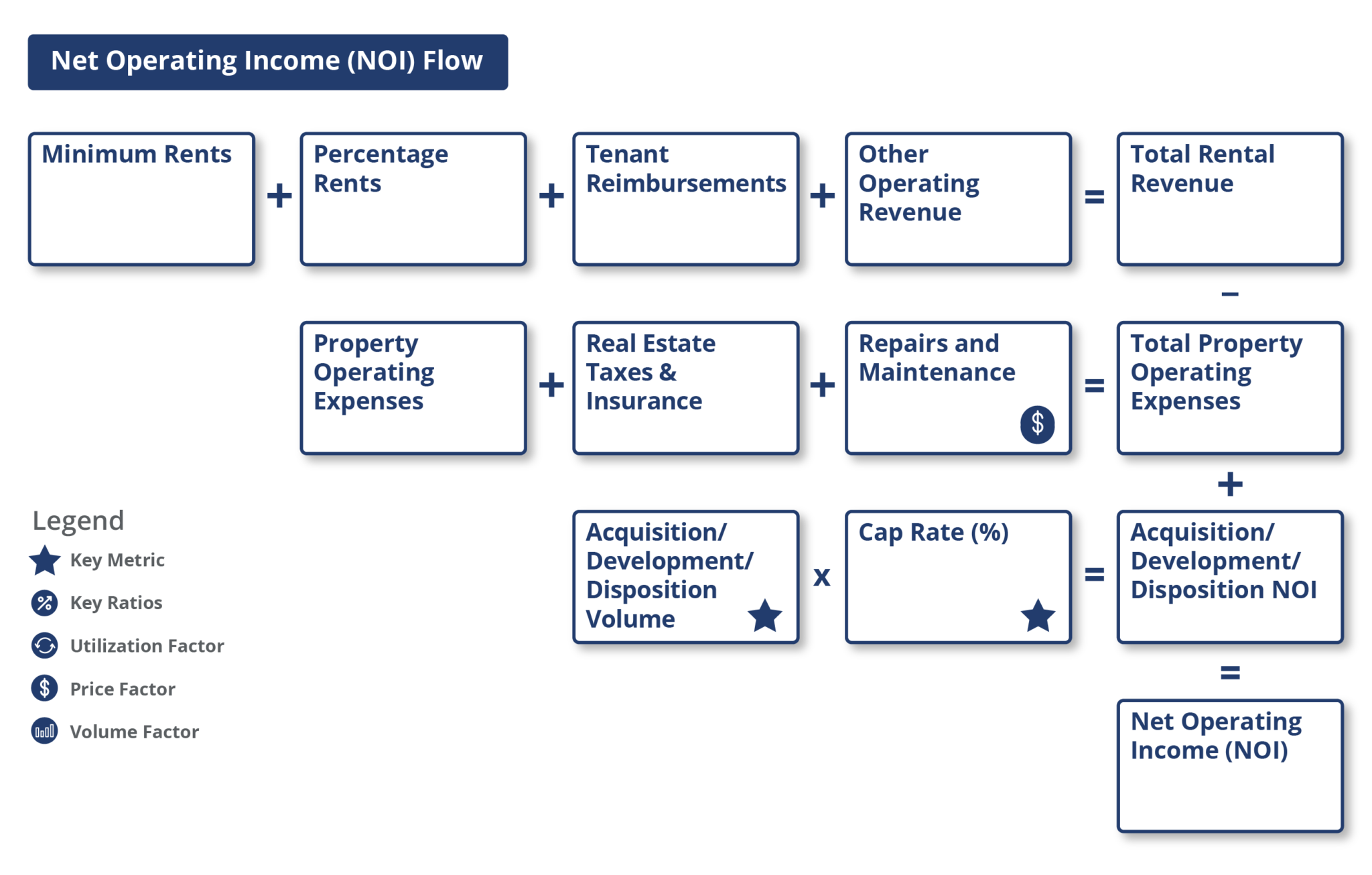

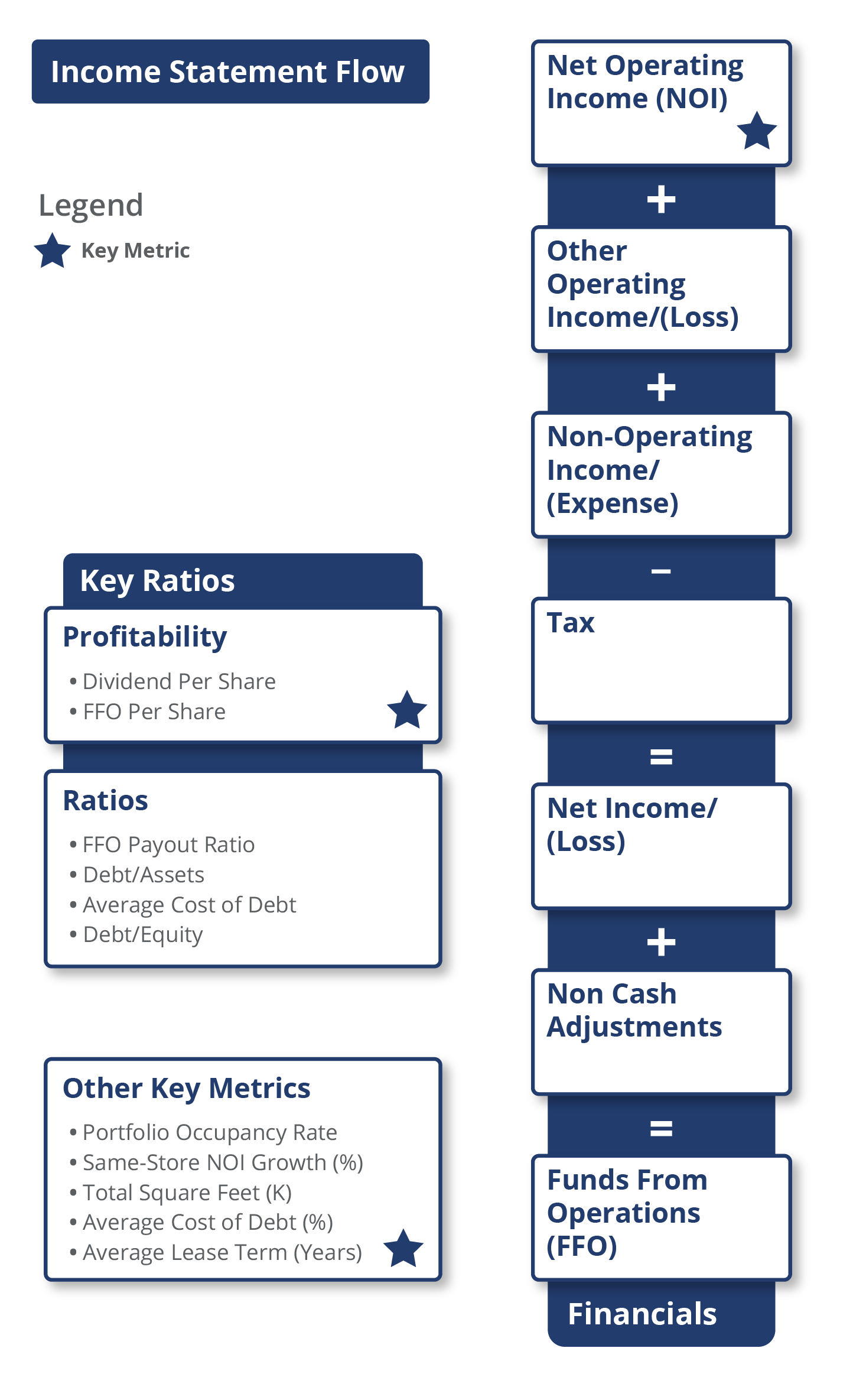

Guide To Retail Reits Industry Kpis Visible Alpha

Reit Dividends In The Wake Of The Coronavirus

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Quarterly Dividends Unrestricted Model Download Table

The Impact Of South African Real Estate Investment Trust Legislation On Firm Growth And Firm Value

The Impact Of South African Real Estate Investment Trust Legislation On Firm Growth And Firm Value

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

Guide To Retail Reits Industry Kpis Visible Alpha

The Impact Of South African Real Estate Investment Trust Legislation On Firm Growth And Firm Value

South Africa Reits Investing Offshore International Tax Review

South Africa Reits Investing Offshore International Tax Review

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide